Jamie Golombek: Potentialities embrace modifications to the capital positive factors inclusion price, retirement taxes and prime tax bracket

Evaluations and suggestions are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made by way of hyperlinks on this web page.

Article content material

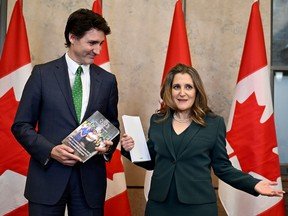

What may very well be within the federal budget that Finance Minister Chrystia Freeland is delivering on April 16? It’s actually anybody’s guess, however some insights might be gleaned from the federal government’s latest pre-budget report, in addition to from numerous pre-budget business newsletters, every providing up their very own predictions and suggestions of what could be in retailer.

Let’s overview some potential tax modifications we may see subsequent month.

Commercial 2

Article content material

Article content material

Various minimal tax

Among the many 359 suggestions contained inside the Standing Committee on Finance’s 344-page report is that earlier than continuing with the proposed modifications to the Alternative Minimum Tax, the federal government ought to decide the influence these modifications may have on charitable revenues by conducting an unbiased financial and monetary evaluation.

The AMT imposes a minimal stage of tax on taxpayers who declare sure deductions, exemptions or credit to cut back the tax they owe to very low ranges. In final yr’s federal funds, the federal government introduced that “to raised goal the AMT to high-income people,” a number of modifications could be made to the foundations for calculating the AMT, starting in 2024.

The modifications, which have been formally launched in Parliament final summer season, however haven’t but been handed into regulation, embrace elevating the AMT price to twenty.5 per cent from 15 per cent, growing the quantity of revenue beneath which AMT won’t apply ($173,205 in 2024) and broadening the AMT base by limiting extra quantities that cut back taxes. All provinces and territories additionally impose AMT, which is usually calculated as a share of the federal AMT.

Article content material

Commercial 3

Article content material

Since AMT can solely come up in 2024 in case your revenue calculated beneath the foundations exceeds the $173,205 AMT exemption, most taxpayers don’t have to fret about it. However AMT might be a problem for higher-income taxpayers who make charitable presents in 2024 due to a few modifications that particularly goal charitable giving.

First, solely 50 per cent of the donation tax credit score is permitted when calculating the AMT, in accordance with the at the moment drafted AMT guidelines for 2024. This alone, nevertheless, isn’t sufficient to trigger AMT, even for high-income donors. It’s solely a priority when a donor earns some tax-preferred revenue or takes sure deductions. For instance, a donor who has a big capital achieve, workouts qualifying worker inventory possibility advantages or has losses carried ahead from a previous yr may very well be affected.

The second AMT adjustment is expounded to in-kind donations of publicly traded shares, mutual funds or segregated funds to a registered charity. Beginning this yr, the draft AMT laws requires 30 per cent of the capital positive factors on securities which can be donated in sort to be included in revenue for AMT functions. Since solely 50 per cent of the donation credit score is now allowed for AMT functions (as defined above), the result’s that the AMT could consequence on some important donations of publicly listed securities in 2024.

Commercial 4

Article content material

A lot lobbying by the charitable sector has taken place because the new AMT guidelines have been initially launched, and the federal government will hopefully backtrack and reverse these two tax measures that might discourage, or on the very least cut back, giant charitable presents in 2024 and future years.

Lifetime capital positive factors exemption

One other suggestion contained within the authorities’s pre-budget report is to extend the lifetime capital positive factors exemption (LCGE) that applies on the sale of certified small enterprise company shares, and farm or fishing property. For 2024, the LCGE exempts a bit greater than $1 million of capital gains arising from the sale of any of those properties from tax, with the unsheltered portion taxable on the regular 50 per cent capital positive factors inclusion price.

The Canadian Federation of Agriculture really helpful growing the LCGE for farming properties “to be extra consistent with present market values to permit further exemption on lands offered to new entrants and/or younger farmers.” Equally, the Canadian Federation of Impartial Enterprise really helpful the LCGE be bumped as much as $1.2 million on the sale of all small and medium-sized enterprises.

Commercial 5

Article content material

Retirement taxes

A number of of the varied suggestions contained within the C.D. Howe Institute’s 2024 Shadow Budget have been geared toward supporting Canada’s growing old inhabitants. For these of us nonetheless saving for retirement, the institute really helpful growing the registered retirement financial savings plan contribution restrict by three share factors of revenue per yr — from the present 18 per cent to 30 per cent of the prior yr’s earned revenue — over 4 years.

For present seniors, C.D. Howe is looking for a right away one-percentage-point discount of minimal withdrawals from registered retirement revenue funds (RRIFs) for every age, starting with the 2024 taxation yr. That is per the June 2023 findings of a government study on RRIFs, which indicated many seniors really feel that RRIF minimal withdrawals, and their interplay with different income-tested authorities advantages such because the Assured Earnings Complement, restrict their skill to optimize their monetary planning by way of their retirement years.

Prime tax bracket

The highest federal tax price of 33 per cent at the moment kicks in at an revenue of greater than $246,752 for 2024. It’s possible you’ll recall the NDP’s 2021 pre-election platform proposed to extend the highest price by two share factors to 35 per cent.

Commercial 6

Article content material

Is that this nonetheless on the desk, given the minority authorities and the Liberal-NDP Supply and Confidence Agreement signed again in March 2022? Onerous to inform, but when it goes by way of, this might convey the highest mixed federal/provincial marginal tax price to roughly 56 per cent in British Columbia, Ontario and Nova Scotia, and to 57 per cent in Newfoundland and Labrador.

Capital positive factors inclusion price

Within the weeks main as much as each spring funds, we all the time speculate about whether or not the federal government may enhance the capital positive factors inclusion from 50 per cent to some greater quantity. The NDP’s 2021 election platform proposed a hike to 75 per cent.

Really useful from Editorial

My wager is {that a} normal enhance within the inclusion price is unlikely given the latest modifications to the AMT for 2024, which make capital positive factors taxable at a 100 per cent inclusion price for top income-earners topic to AMT.

That stated, if a change is introduced to the final capital positive factors inclusion price, it will probably be efficient as of funds day (April 16). This implies buyers who concern a bump within the inclusion price may think about accelerating any planning, together with a possible rebalancing of their portfolios by taking positive factors now, thereby locking in a 50 per cent inclusion price.

Jamie Golombek, FCPA, FCA, CFP, CLU, TEP, is the managing director, Tax & Property Planning with CIBC Non-public Wealth in Toronto. Jamie.Golombek@cibc.com.

In case you preferred this story, join extra within the FP Investor e-newsletter.

Article content material